IFO Releases

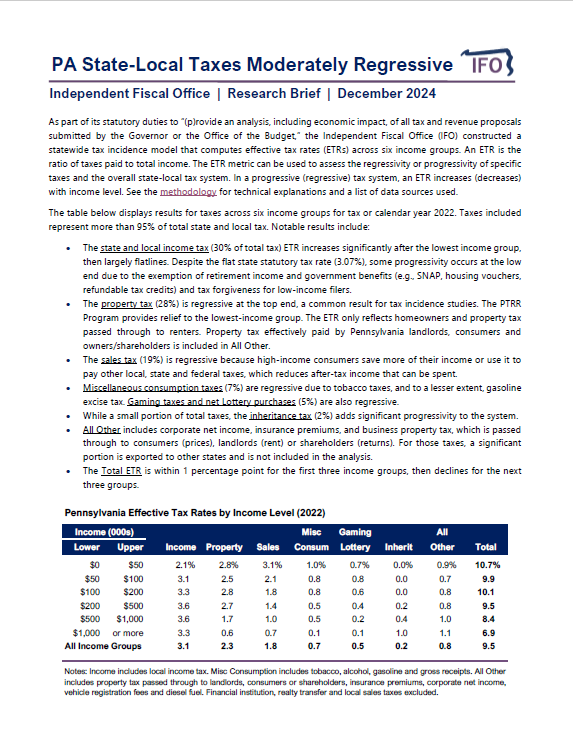

PA State-Local Taxes Moderately Regressive

December 17, 2024 | Economics and Other

As part of its statutory duties, the IFO must “(p)rovide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget.” Tax incidence is a key component of any economic impact analysis. This research brief and methodology compute effective tax rates (ETRs) to track tax incidence and assess the progressivity or regressivity of specific taxes and the overall state and local tax system. The methodology provides a detailed explanation of the data sources and assumptions used by the analysis.

Gasoline Revenues Down $250 Million Annually

December 12, 2024 | Economics and Other

This research brief examines gasoline purchases four years after the height of the pandemic. Gasoline tax revenue is down $250 million per annum due to reduced consumption.

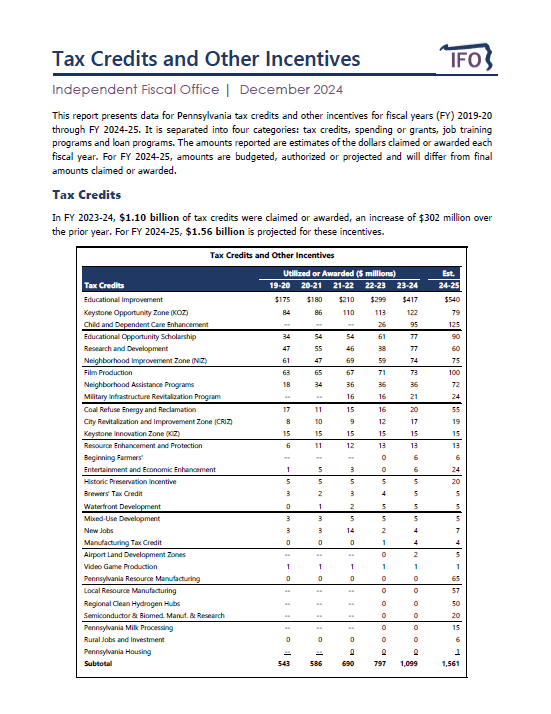

Tax Credits and Economic Development Incentives

December 10, 2024 | Economics and Other

This report presents data on Pennsylvania tax credits and economic development incentives for fiscal years (FY) 2019-20 through FY 2024-25. The tables provide annual detail on tax credit utilization or awards, state spending or grants, job training programs and state loan programs. Fiscal year 2024-25 amounts are budgeted, authorized or projected and will differ from final amounts claimed or awarded. The report also highlights recent changes to incentive program spending or utilization.

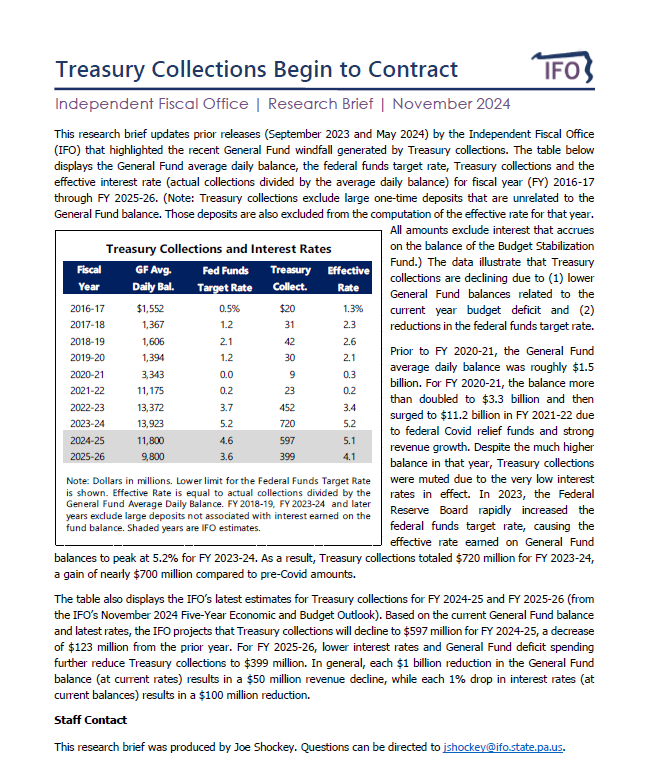

Treasury Collections Begin to Contract

November 25, 2024 | Economics and Other

After peaking in FY2023-24 at $720 million, Treasury collections are projected to drop by $321 million (-45%) for FY2025-26 due to General Fund deficit spending and declining interest rates.

2024 Demographic Outlook

October 24, 2024 | Economics and Other

Section 604-B (a)(2) of the Administrative Code of 1929 specifies that the Independent Fiscal Office (IFO) shall “provide an assessment of the state’s current fiscal condition and a projection of what the fiscal condition will be during the next five years. The assessment shall take into account the state of the economy, demographics, revenues and expenditures.” This report fulfills the demographics obligation of this statute. The IFO will release the Economic and Budget Outlook for Fiscal Years 2024-25 to 2029-30 in November 2024.

How Did School Districts Use COVID Funds?

October 22, 2024 | Economics and Other

This research brief uses data from the Pennsylvania Department of Education to examine how school districts used $6.0 billion of temporary COVID-19 funds.

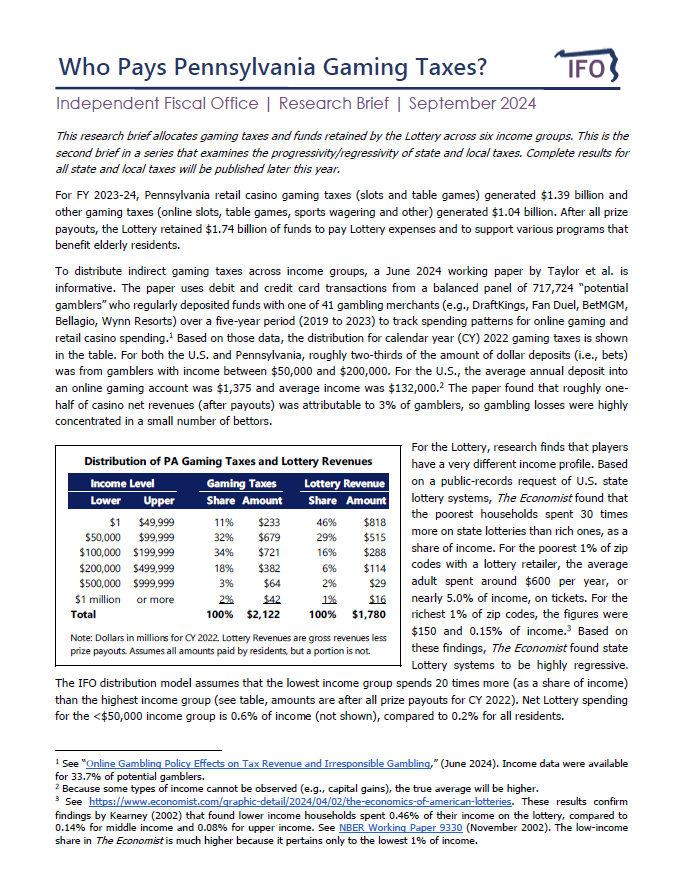

Who Pays Pennsylvania Gaming Taxes?

September 25, 2024 | Economics and Other

This research brief is the second in a series that uses a new distribution model to examine the progressivity/regressivity of state-local taxes. This release examines state and local gaming taxes and funds retained by the Lottery after prize payouts.

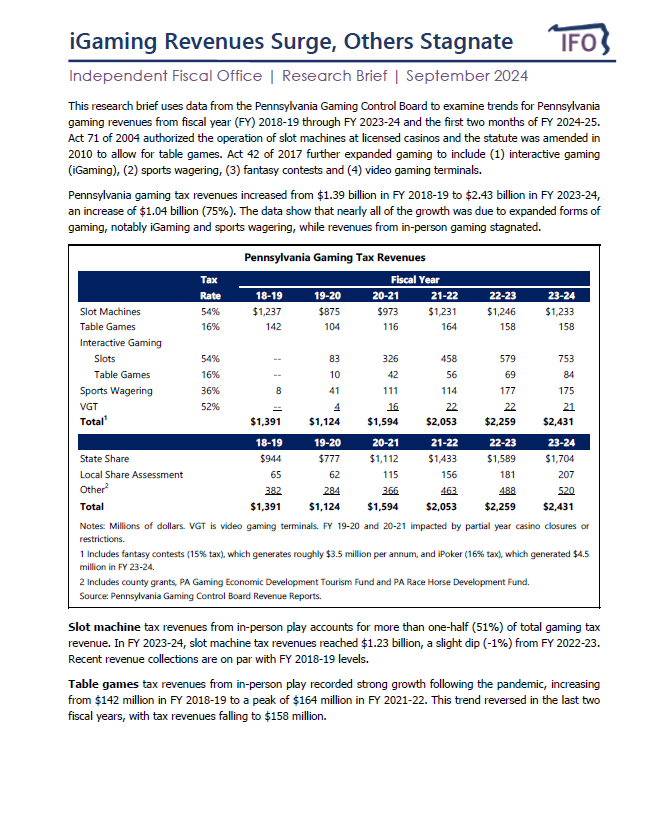

iGaming Revenues Surge, Others Stagnate

September 23, 2024 | Economics and Other

This research brief uses data from the Pennsylvania Gaming Control Board to examine trends for Pennsylvania gaming revenues from fiscal year (FY) 2018-19 through FY 2023-24 and the first two months of FY 2024-25.

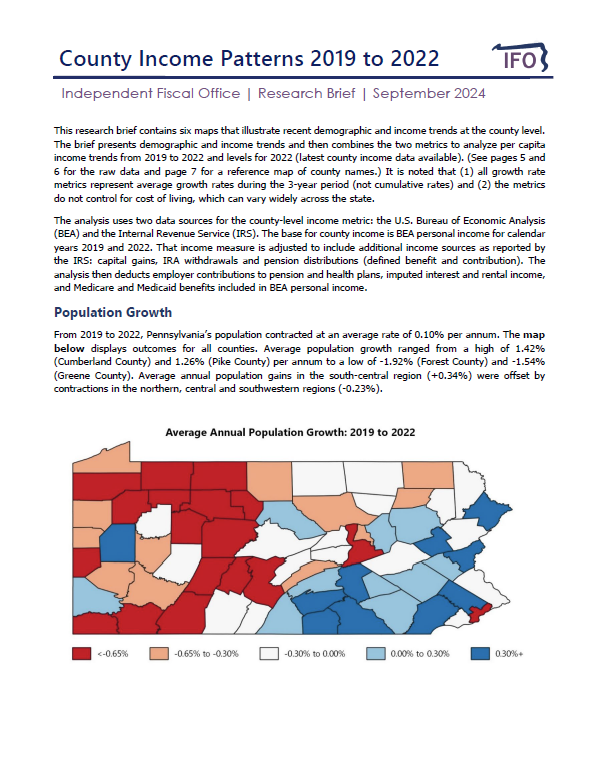

County Income Patterns 2019 to 2022

September 09, 2024 | Economics and Other

This annual research brief uses the latest published data to generate maps and rankings of county demographic and income trends. The release highlights population change, personal income growth, shares of transfer income and per capita amounts for all counties in the Commonwealth.

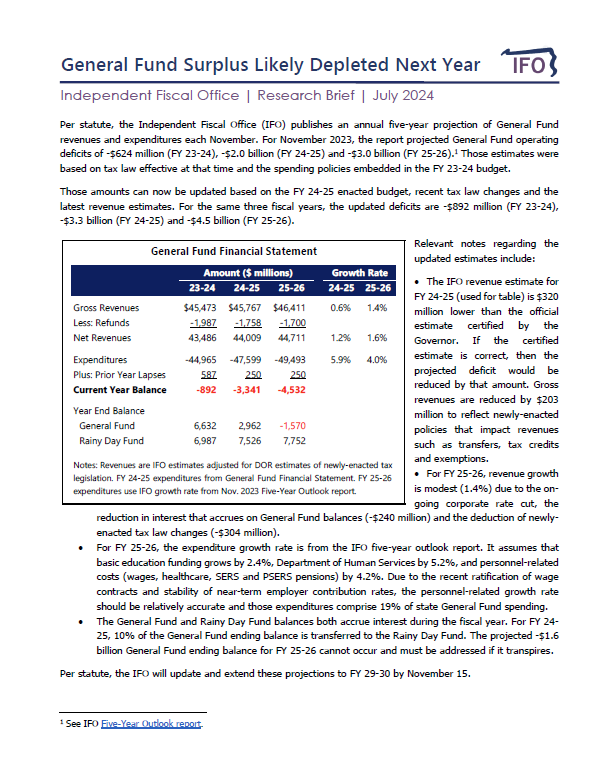

General Fund Surplus Likely Depleted Next Year

July 18, 2024 | Economics and Other

This research brief uses the recently passed state budget for FY 24-25 to update deficit estimates for the current and subsequent fiscal year.