IFO Releases

Homestead Exclusion and PIT

March 13, 2019 | Property Tax

In response to a legislative request, the IFO transmitted a letter that computes the level of personal income tax (PIT) increase needed to fully fund a 100% homestead exclusion for school district property taxes.

PROPERTY TAX ELIMINATION PROJECTION

February 27, 2019 | Property Tax

In response to a legislative request, the IFO has updated projections regarding school district property tax elimination. The document projects the school property tax revenues that would be subject to replacement under potential legislation that would eliminate school property taxes.

Property Tax Update - August 2018

August 17, 2018 | Property Tax

In response to a legislative request, the IFO updated select tables and graphs related to school district property tax that were originally released in January and December of 2017.

Budget And Economic Update with Property Tax Discussion

June 05, 2018 | Property Tax

Director Matthew Knittel gave a budget and economic update to the Pennsylvania Association of School Business Officials (PASBO). Revenue Analyst Jesse Bushman also discussed an updated school district property tax forecast and recent proposed legislation.

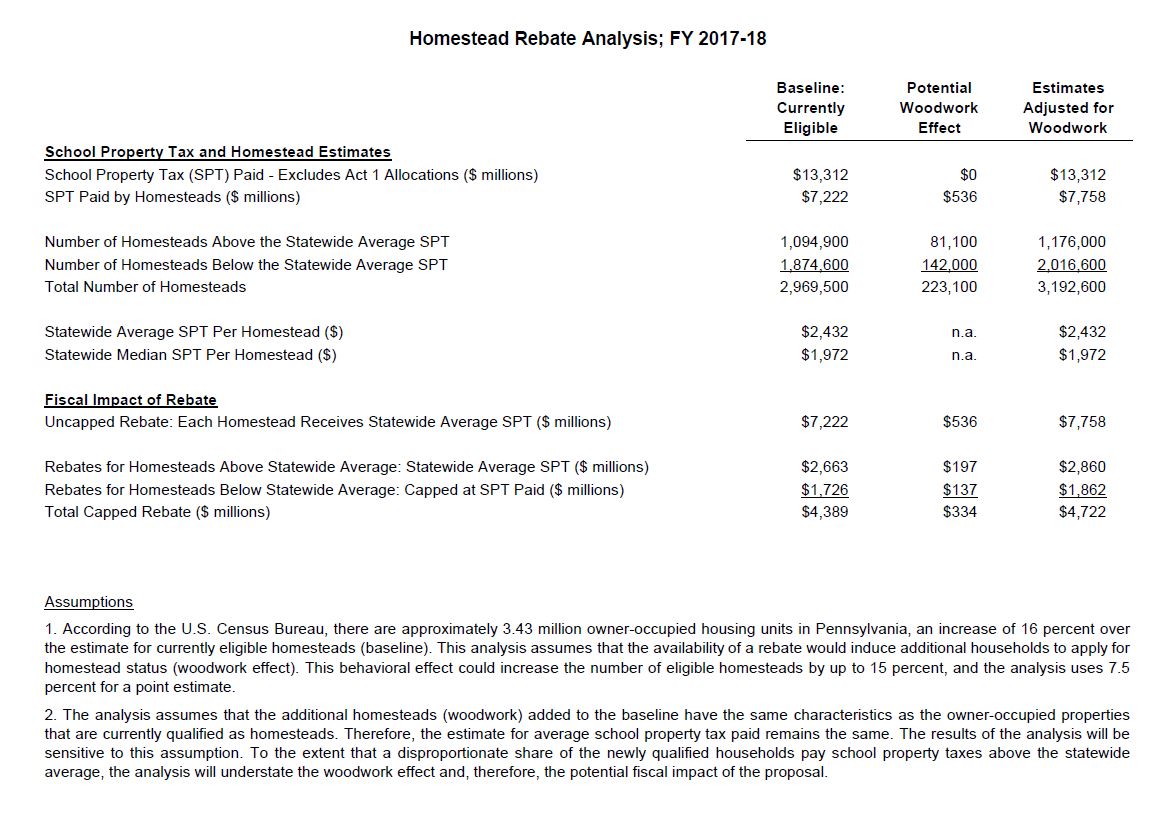

Fiscal Impact of School Property Tax Rebates

March 13, 2018 | Property Tax

In response to a legislative request, the IFO estimated the fiscal impact of a school property tax rebate for all homesteads. The rebate would be equal to the statewide average school property tax paid by homesteads. The response includes both baseline estimates for currently eligible homesteads and estimates for a behavioral effect based on the filing of additional homestead applications in response to the availability of rebates.

School District Property Tax Forecast

January 18, 2018 | Property Tax

This research brief contains the IFO's forecasted school district property tax collections from FY 2016-17 through FY 2022-23. The brief also contains estimates of school district property tax collections that can be attributed to homestead property.

Total school property tax collections for FY 2016-17 ($14.0 billion) and FY 2017-18 ($14.4 billion) are estimated using millage rates published by the Pennsylvania Department of Education and property tax assessment data. For FY 2018-19 through FY 2022-23, collections are projected based on the statutory, economic and structural factors that affect growth rates of property taxes. During that period, total school property tax collections are projected to grow by an average annual rate of 3.3 percent, reaching $17.0 billion by FY 2022-23.

School Property Taxes; Households Age 60, 65 and 70 or Older

December 11, 2017 | Property Tax

In response to a legislative request, the IFO analyzed data from the American Community Survey (ACS) to estimate the share of school property taxes paid by households in which the householder (or spouse, if applicable) had attained the ages 60 or over, 65 or over and 70 or over. The analysis applies the shares derived from the ACS to estimated school district property tax collections attributable to homestead properties for FY 2015-16 to further estimate the dollar amounts paid by such households.

County Homestead Detail

December 06, 2017 | Property Tax

As an extension of its recent research relating to property taxes, the IFO has released additional data regarding homestead property. Estimates for the numbers and assessed values of homestead properties by county are based, in large part, on the results of a survey of county assessment offices. The County Commissioners Association of Pennsylvania provided valuable assistance by coordinating the survey. Data for Philadelphia has been adjusted based on new information provided by the Philadelphia Department of Revenue.

School Property Tax and Related Data

November 13, 2017 | Property Tax

In response to a legislative request, the IFO collected and analyzed certain data related to school property taxes and potential replacement revenues. Data for Philadelphia in Table 3 has been adjusted based on information provided by the Philadelphia Department of Revenue.

An Overview of School District Property Tax Reform

May 04, 2017 | Property Tax

Throughout May, Director Matt Knittel and Deputy Director Mark Ryan will make five presentations on the potential implications of school district property tax reform. The events are sponsored by the Pennsylvania Economy League and will take place at the various locations listed below.

Click the following links for additional details:

READING Thursday May 4th 7:30-9:00am

WILLIAMSPORT Friday May 5th 12:00-1:30pm

YORK Thursday May 11th 12:00-1:30pm

WILKES-BARRE Friday May 12th 12:00-1:30pm

LEHIGH VALLEY Friday May 19th 12:00-1:30pm