IFO Releases

Budget Hearing Materials 2023

March 16, 2023 | Economics and Other

The Independent Fiscal Office submitted materials to the Senate Appropriations Committee ahead of its budget hearing. The packet includes data on the state economy, revenues, demographics and other miscellaneous topics.

Economic and Act 1 Index Update

March 16, 2023 | Economics and Other

Director Knittel gave an Economic and Act 1 Index update at the Pennsylvania Association of School Business Officials (PASBO) Annual Conference.

Economic Update

March 13, 2023 | Economics and Other

Director Knittel provided an economic update to the PA Chamber of Business and Industry.

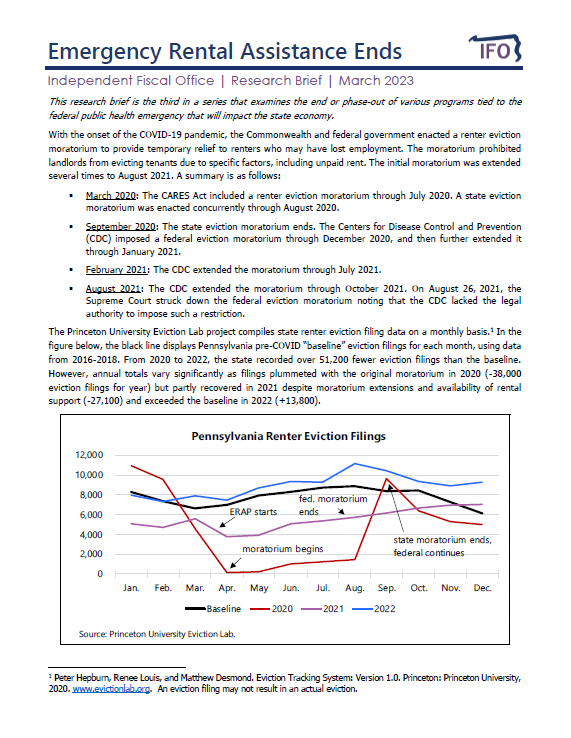

Emergency Rental Assistance Ends

March 06, 2023 | Economics and Other

The IFO posted a third research brief that examines the end or phase-out of various programs tied to the federal public health emergency that will impact the state economy. The brief examines trends in eviction filings since the onset of the pandemic and the use of $1.6 billion in funds received for the Emergency Rental Assistance Program throughout the state.

Tags: assistance, brief, rental, research

Impact of Proposed Changes to the NOL Cap

February 24, 2023 | Economics and Other

The IFO published a letter in response to a request from Senator Pennycuick. The letter contains projections for the impact of proposed changes to the amount of taxable income that C corporations may offset through net operating loss deductions.

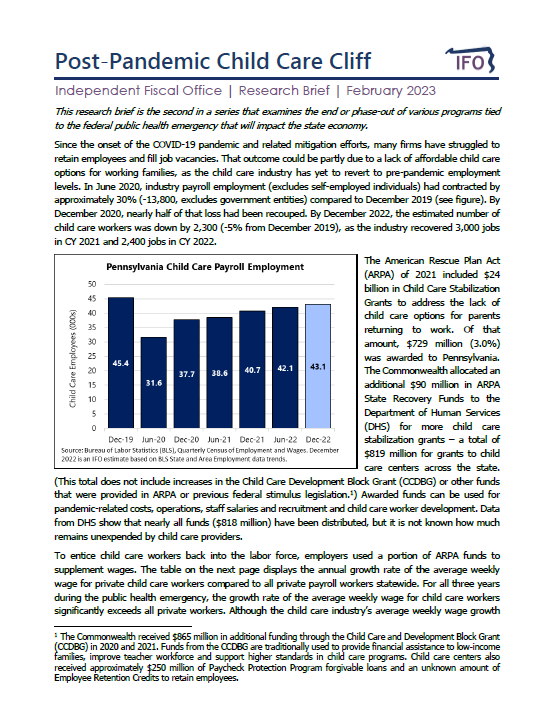

Post-Pandemic Child Care Cliff

February 23, 2023 | Economics and Other

The IFO posted a second research brief that examines the end or phase-out of various programs tied to the federal public health emergency that will impact the state economy. The brief examines the impact that nearly $820 million in federal support had on the child care industry and its employees, and the funding cliff the industry will encounter in the near future.

State and Local Tax Revenues: A 50 State Comparison

February 21, 2023 | Economics and Other

This report uses data from the U.S. Census Bureau, the Internal Revenue Service (IRS), the U.S. Bureau of Economic Analysis and the Federation of Tax Administrators to facilitate a comparison of state and local tax systems across the 50 states. The report examines (1) the relative level of state and local taxes across states, (2) the distribution of state and local taxes across revenue sources (e.g., income, sales and property) and (3) state debt levels.

Tags: comparison, local, state, tax

Economic and Budget Outlook Hearing Request

February 10, 2023 | Economics and Other

The IFO published a letter in response to requests for additional information raised at a recent economic and budget outlook hearing on January 24, 2023.

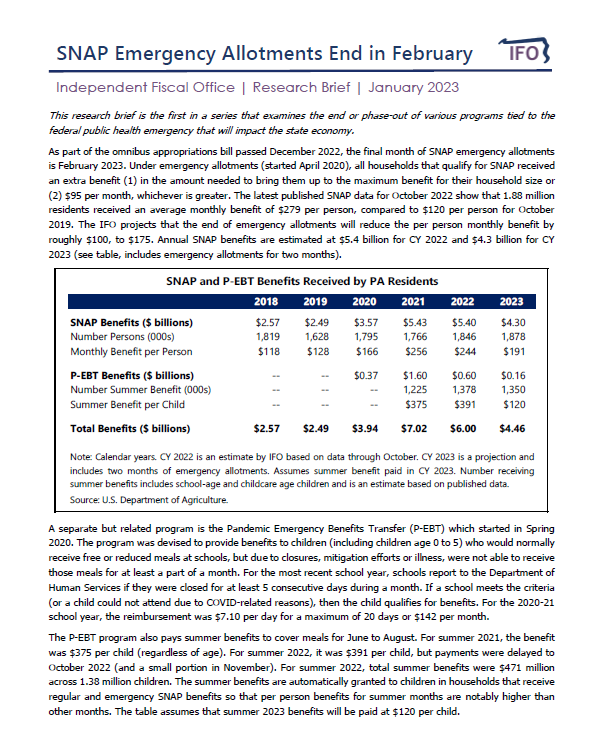

SNAP Emergency Allotments End in February

January 27, 2023 | Economics and Other

The IFO posted a research brief that is the first in a series that examines the end or phase-out of various programs tied to the federal public health emergency that will impact the state economy. The brief quantifies the impact from the end of SNAP emergency allotments in February 2023.

This research brief was reposted on February 2, 2023 to change the 2023 summer benefit to $120 per child.

Analysis of Proposed Changes to State Motor Fuel Taxes

January 26, 2023 | Economics and Other

The IFO published a letter in response to a request from Chairman Grove for a static and dynamic analysis of proposed changes to state motor fuel taxes. The proposal would reduce those taxes and replace lost revenues with motor vehicle sales and use taxes.