IFO Releases

Executive Budget Revenue Proposals

March 04, 2025 | Revenue Estimates

This brief provides a summary of estimates for revenue proposals included in the FY 2025-26 Executive Budget, and a comparison to the estimates from that document. For a more detailed explanation of the data and methodologies used for estimates, see the Analysis of Revenue Proposals released concurrently with this brief.

Analysis of Revenue Proposals

March 04, 2025 | Revenue Estimates

This report provides estimates for the revenue proposals contained in the FY 2025-26 Governor's Executive Budget released February 2025. The Independent Fiscal Office (IFO) publishes this report to fulfill its statutory duties as provided under Section 604-B (a)(4) of the Administrative Code of 1929. The act requires that the IFO “provide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget."

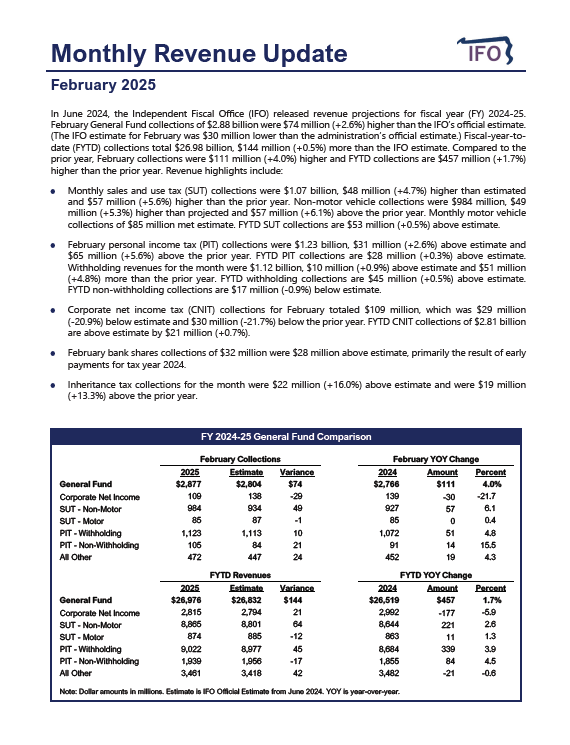

February 2025 Revenue Update

March 03, 2025 | Revenue & Economic Update

The Commonwealth collected $2.88 billion in General Fund revenues for February, an increase of $111 million compared to February 2024.

Natural Gas Production Report: 2024 Q4

February 25, 2025 | Energy

This document uses data from the Pennsylvania Department of Environmental Protection, the U.S. Energy Information Administration and Natural Gas Intelligence to provide a quarterly update on recent trends in production volume, well counts and average spot prices.

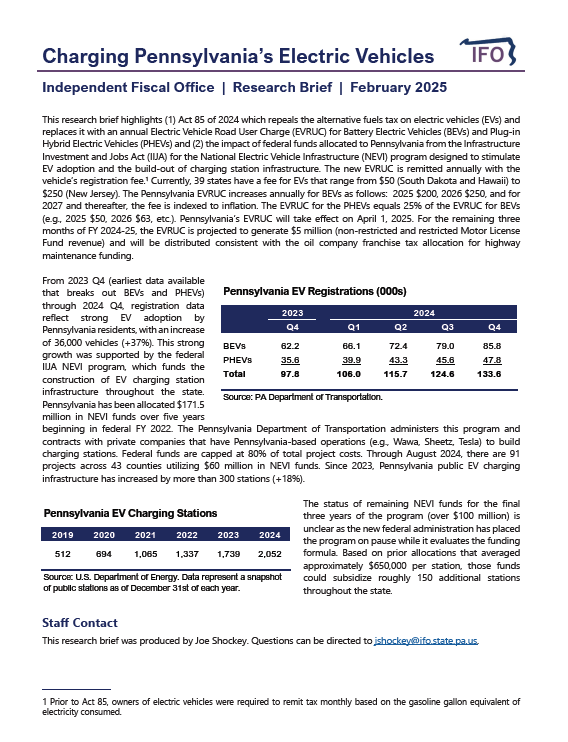

Charging Pennsylvania’s Electric Vehicles

February 24, 2025 | Economics and Other

A new research brief examines Act 85 of 2024, which replaces the alternative fuel tax on electric vehicles with an annual electric vehicle road user charge for battery electric and plug-in hybrid vehicles. It also details the impact of federal funds from the Infrastructure Investment and Jobs Act on Pennsylvania’s EV charging infrastructure.

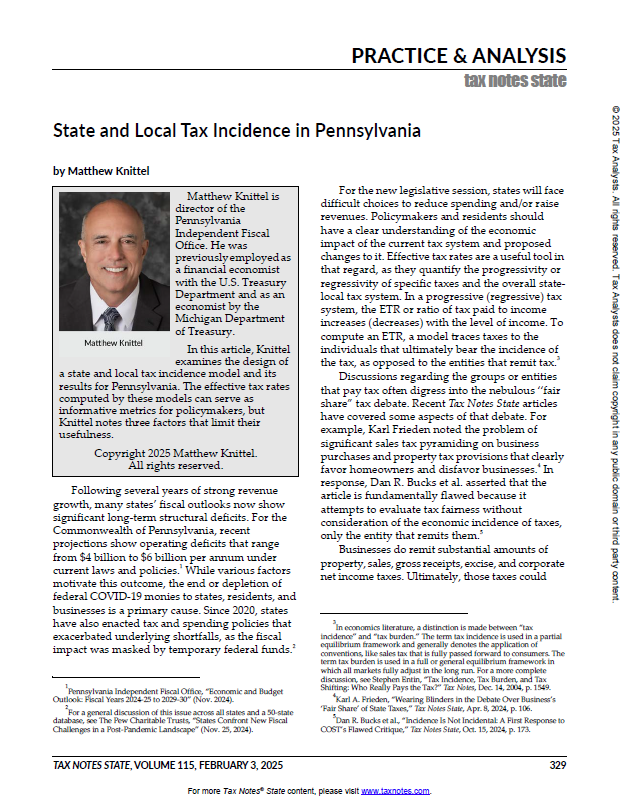

State and Local Tax Incidence in Pennsylvania

February 19, 2025 | Economics and Other

Director Knittel submitted an article for publication in the February 3, 2025 edition of Tax Notes State. It reviews recent results from the Pennsylvania tax incidence model and discusses factors that make state and local tax systems appear more regressive than they are in practice.

State and Local Tax Revenues: A 50 State Comparison

February 13, 2025 | Economics and Other

This report uses data from the U.S. Census Bureau, the Internal Revenue Service (IRS), the U.S. Bureau of Economic Analysis (BEA) and other sources to facilitate a comparison of state and local tax systems across the 50 states. The report examines (1) state and local effective tax rates across states, (2) the distribution of state and local taxes across revenue sources (e.g., income, sales and property) and (3) state debt levels.

Long-Term Budget Outlook Update

February 11, 2025 | Economics and Other

The IFO updated its baseline deficit projections based on new spending data from the Executive Budget. The revised projections are $3.5 billion (24-25), $6.0 billion (25-26) and $6.9 billion (26-27) under current laws and policies. If the projections hold, then the General Fund surplus would be depleted in 25-26 and the Rainy Day Fund in 26-27.

Economic Forum

February 03, 2025 | Economics and Other

Director Knittel made a brief presentation at the NFIB Economic Forum.

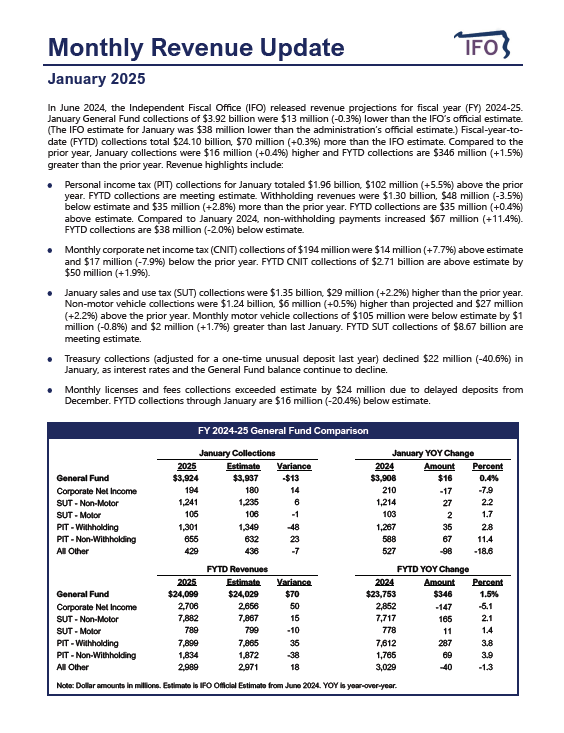

January 2025 Revenue Update

February 03, 2025 | Revenue & Economic Update

The Commonwealth collected $3.92 billion in General Fund revenues for January, an increase of $16 million compared to January 2024.