IFO Releases

Retail Delivery Fee Revenue Estimates

April 23, 2025 | Economics and Other

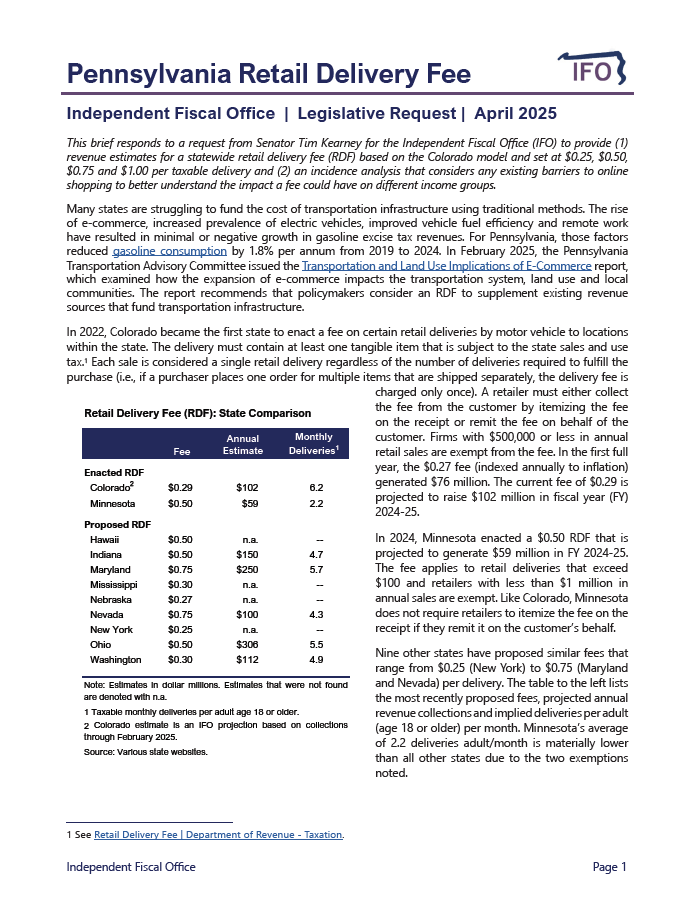

In response to a legislative request, the IFO transmitted a brief that provides revenue estimates for a statewide retail delivery fee.

Unemployment Claims Tracker

April 10, 2025 | Economics and Other

This economic brief tracks the latest claims for unemployment compensation (UC) for all covered workers and federal workers only. The IFO is tracking these claims in preparation for its May 20 initial revenue estimate.

FY 2024-25 Interim Revenue Update

April 03, 2025 | Economics and Other

This budget update supplements the regular monthly revenue update published by the IFO and provides additional detail for March General Fund revenues. March revenues include large payments for gross receipts, insurance premiums, bank shares and corporate net income taxes.

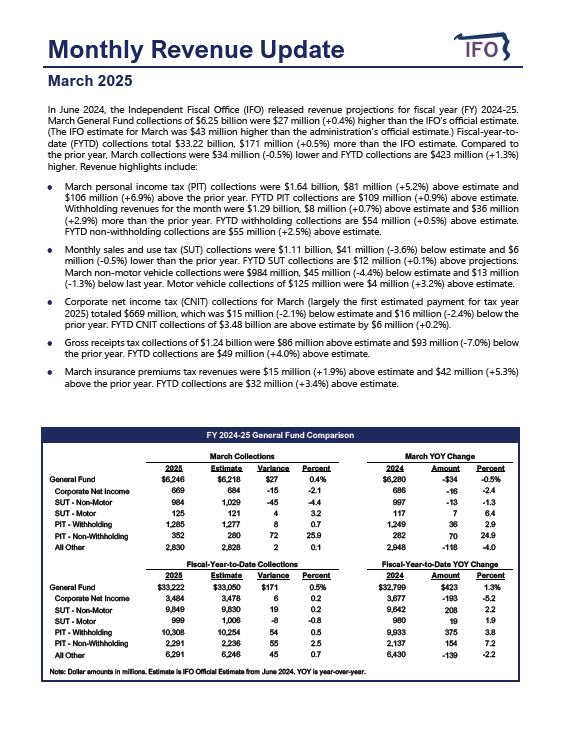

March 2025 Revenue Update

April 01, 2025 | Revenue & Economic Update

The Commonwealth collected $6.25 billion in General Fund revenues for March, a decrease of $34 million (-0.5%) compared to March 2024.

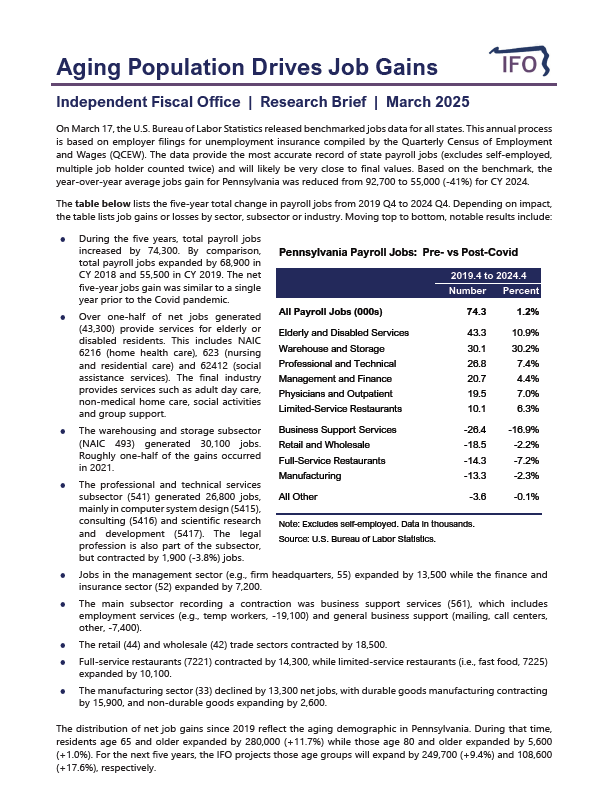

Aging Population Drives Job Gains

March 20, 2025 | Economics and Other

This research brief uses new benchmarked jobs data from the U.S. Bureau of Labor Statistics to track the sectors and industries that gained or lost jobs since 2019 (i.e., pre-Covid).

2025 County Millage Rates

March 17, 2025 | Property Tax

The IFO released a research brief that reviews county-level millage rate changes for CY 2025 and the prior decade.

This brief was updated on March 20, 2025 to correct an issue related to counties characterized as reassessed.

Analysis of Revenue Proposals

March 04, 2025 | Revenue Estimates

This report provides estimates for the revenue proposals contained in the FY 2025-26 Governor's Executive Budget released February 2025. The Independent Fiscal Office (IFO) publishes this report to fulfill its statutory duties as provided under Section 604-B (a)(4) of the Administrative Code of 1929. The act requires that the IFO “provide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget."

Executive Budget Revenue Proposals

March 04, 2025 | Revenue Estimates

This brief provides a summary of estimates for revenue proposals included in the FY 2025-26 Executive Budget, and a comparison to the estimates from that document. For a more detailed explanation of the data and methodologies used for estimates, see the Analysis of Revenue Proposals released concurrently with this brief.

This document was reposted on March 6 to address a formatting issue. All figures are unchanged from the original posting.

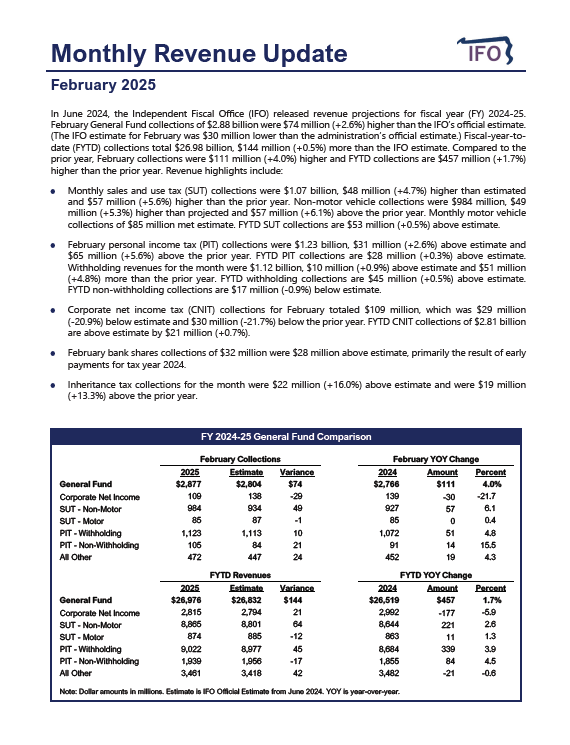

February 2025 Revenue Update

March 03, 2025 | Revenue & Economic Update

The Commonwealth collected $2.88 billion in General Fund revenues for February, an increase of $111 million compared to February 2024.

Natural Gas Production Report: 2024 Q4

February 25, 2025 | Energy

This document uses data from the Pennsylvania Department of Environmental Protection, the U.S. Energy Information Administration and Natural Gas Intelligence to provide a quarterly update on recent trends in production volume, well counts and average spot prices.