IFO Releases

Pennsylvania's Gasoline Tax

June 13, 2022 | Economics and Other

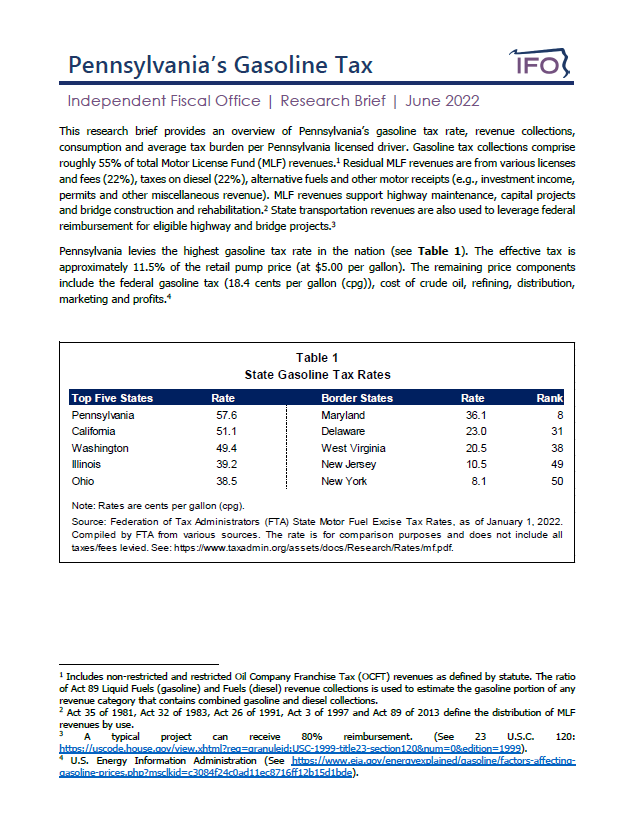

The IFO published a research brief that examines the Pennsylvania gasoline tax, which comprises 55% of Motor License Fund revenues. Although Pennsylvania levies the highest gasoline tax rate in the nation, the analysis finds that collections have not kept pace with the rising cost of road construction. This outcome is largely the result of the tax structure, which is tied to the average wholesale price of fuel and has not increased since 2018. For FY 2021-22, the IFO estimates that the annual gasoline tax burden per licensed Pennsylvania driver is $285.

Inflation's Impact on the Pennsylvania Economy

June 07, 2022 | Economics and Other

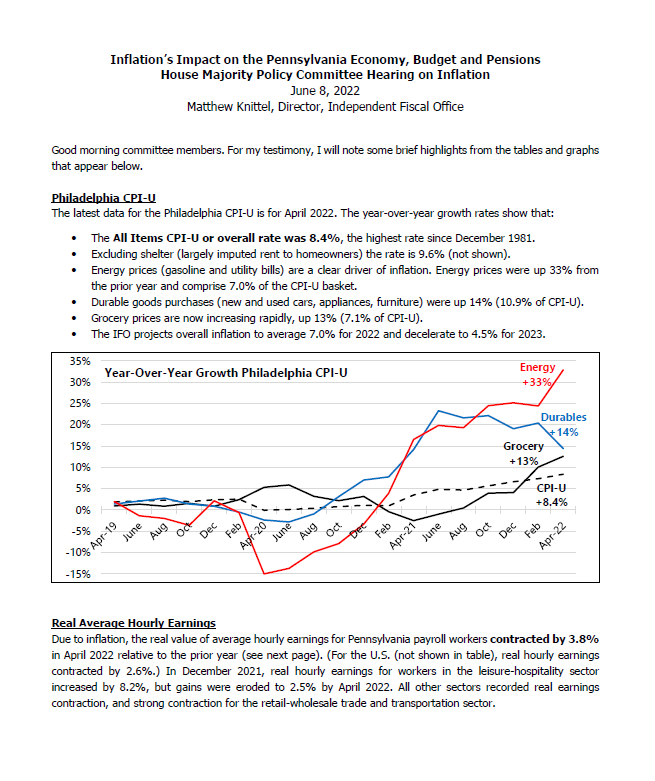

On June 8, Director Matthew Knittel will make a brief presentation to the House Majority Policy Committee on the impact of inflation on the state economy and budget.

Tags: economy, inflation, pennsylvania

PA Residents Migrating to Southern States

June 02, 2022 | Economics and Other

The IFO posted a research brief that uses recent IRS tax data to track migration between states for 2019 and 2020. The IRS data show large net inflows from most border states and net outflows to southern states, most notably Florida. Net outflows were much heavier for residents age 55 and older.