This research brief provides tabulations of corporate net income tax return data for tax year 2021. For that year, 48 returns comprised nearly one quarter of tax liability, and 12.4% of taxable income was offset by net operating loss (NOL) deductions.

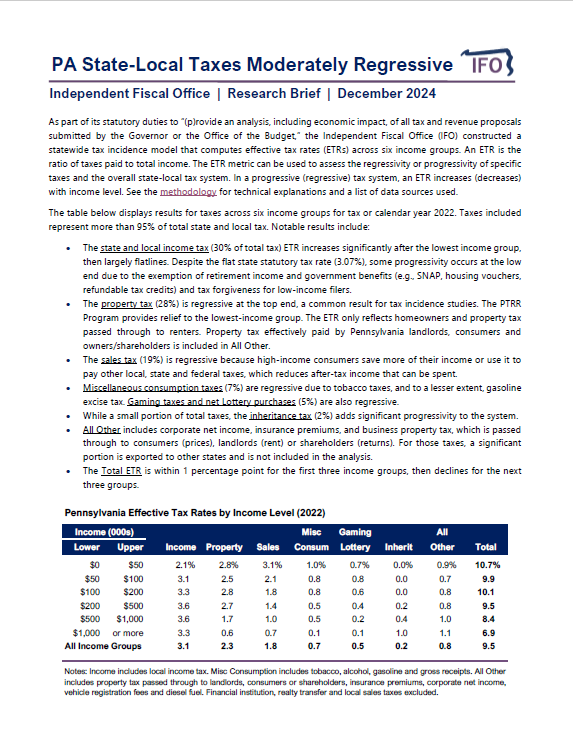

As part of its statutory duties, the IFO must “(p)rovide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget.” Tax incidence is a key component of any economic impact analysis. This research brief and methodology compute effective tax rates (ETRs) to track tax incidence and assess the progressivity or regressivity of specific taxes and the overall state and local tax system. The methodology provides a detailed explanation of the data sources and assumptions used by the analysis.

This research brief examines gasoline purchases four years after the height of the pandemic. Gasoline tax revenue is down $250 million per annum due to reduced consumption.

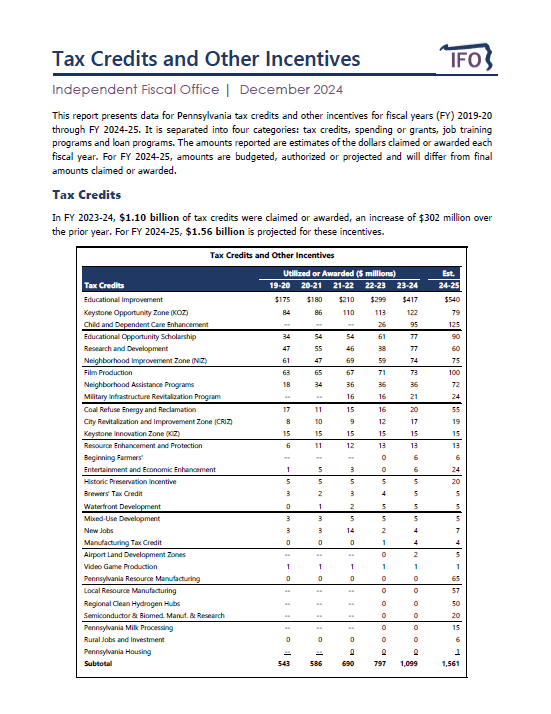

This report presents data on Pennsylvania tax credits and economic development incentives for fiscal years (FY) 2019-20 through FY 2024-25. The tables provide annual detail on tax credit utilization or awards, state spending or grants, job training programs and state loan programs. Fiscal year 2024-25 amounts are budgeted, authorized or projected and will differ from final amounts claimed or awarded. The report also highlights recent changes to incentive program spending or utilization.