IFO Releases

Economic Forum

February 03, 2025 | Economics and Other

Director Knittel made a brief presentation at the NFIB Economic Forum.

Options to Fund School District Property Tax Elimination

January 24, 2025 | Economics and Other

In response to a legislative request, the IFO transmitted a letter that updates a previous analysis on potential revenue sources that could replace school district property taxes if eliminated.

Pennsylvania Child Care Industry Update

January 23, 2025 | Economics and Other

This research brief provides tabulations of child care industry employment, wages and average annual costs. For 2024 Q2, Pennsylvania private child care employment now exceeds pre-pandemic levels (2019 Q2) by 1,200 employees, while average industry wages increased significantly (31%). Child care costs vary widely depending on family income and access to the Child Care Works program.

Corporate Net Income Tax Data 2021

December 31, 2024 | Economics and Other

This research brief provides tabulations of corporate net income tax return data for tax year 2021. For that year, 48 returns comprised nearly one quarter of tax liability, and 12.4% of taxable income was offset by net operating loss (NOL) deductions.

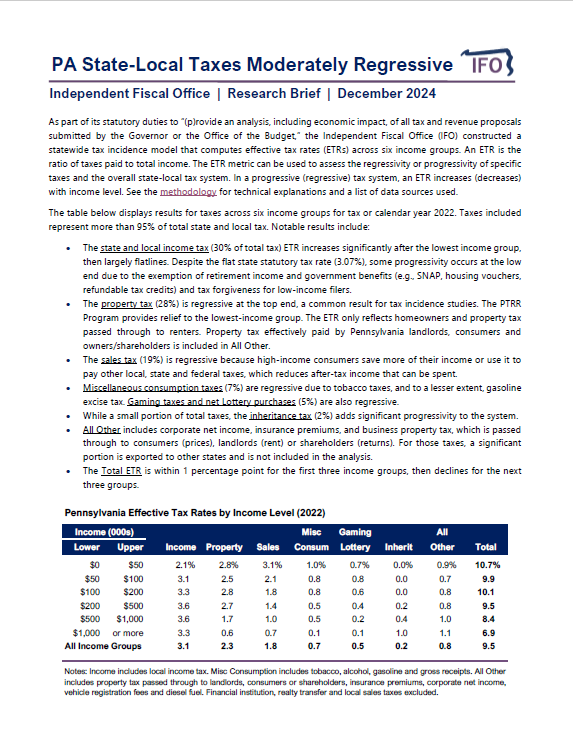

PA State-Local Taxes Moderately Regressive

December 17, 2024 | Economics and Other

As part of its statutory duties, the IFO must “(p)rovide an analysis, including economic impact, of all tax and revenue proposals submitted by the Governor or the Office of the Budget.” Tax incidence is a key component of any economic impact analysis. This research brief and methodology compute effective tax rates (ETRs) to track tax incidence and assess the progressivity or regressivity of specific taxes and the overall state and local tax system. The methodology provides a detailed explanation of the data sources and assumptions used by the analysis.

Gasoline Revenues Down $250 Million Annually

December 12, 2024 | Economics and Other

This research brief examines gasoline purchases four years after the height of the pandemic. Gasoline tax revenue is down $250 million per annum due to reduced consumption.

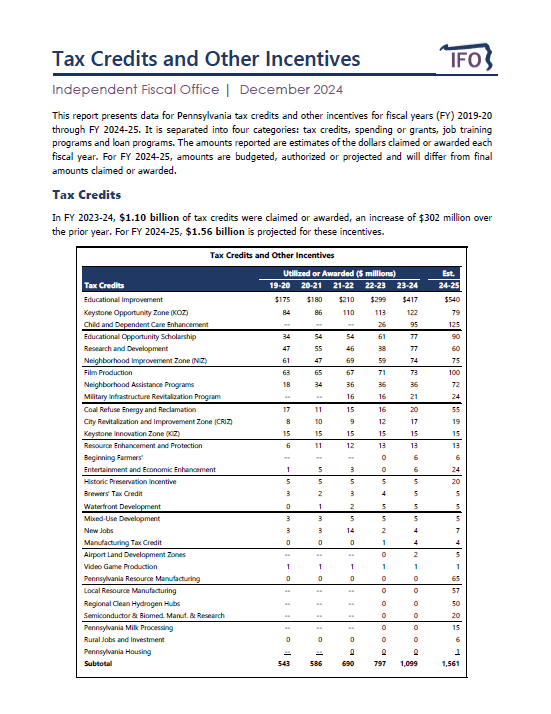

Tax Credits and Economic Development Incentives

December 10, 2024 | Economics and Other

This report presents data on Pennsylvania tax credits and economic development incentives for fiscal years (FY) 2019-20 through FY 2024-25. The tables provide annual detail on tax credit utilization or awards, state spending or grants, job training programs and state loan programs. Fiscal year 2024-25 amounts are budgeted, authorized or projected and will differ from final amounts claimed or awarded. The report also highlights recent changes to incentive program spending or utilization.

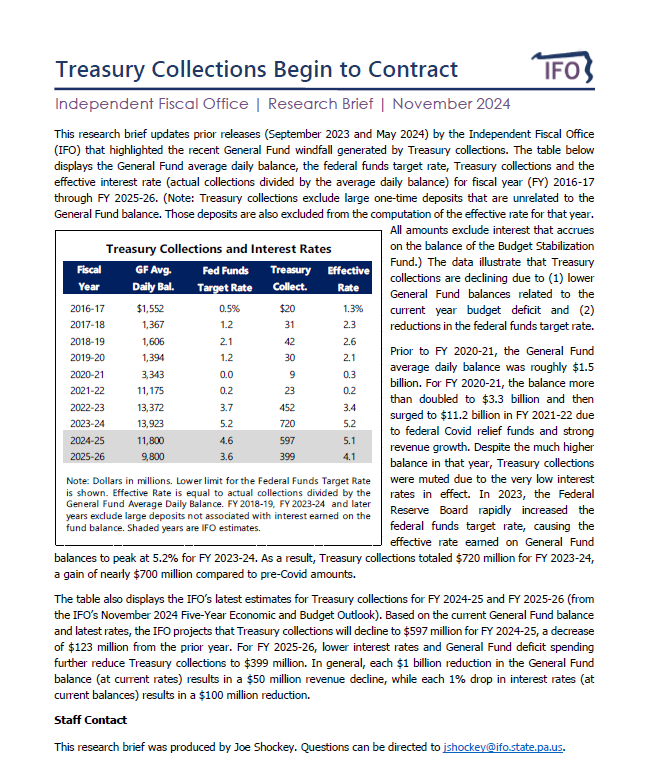

Treasury Collections Begin to Contract

November 25, 2024 | Economics and Other

After peaking in FY2023-24 at $720 million, Treasury collections are projected to drop by $321 million (-45%) for FY2025-26 due to General Fund deficit spending and declining interest rates.

2024 Demographic Outlook

October 24, 2024 | Economics and Other

Section 604-B (a)(2) of the Administrative Code of 1929 specifies that the Independent Fiscal Office (IFO) shall “provide an assessment of the state’s current fiscal condition and a projection of what the fiscal condition will be during the next five years. The assessment shall take into account the state of the economy, demographics, revenues and expenditures.” This report fulfills the demographics obligation of this statute. The IFO will release the Economic and Budget Outlook for Fiscal Years 2024-25 to 2029-30 in November 2024.

How Did School Districts Use COVID Funds?

October 22, 2024 | Economics and Other

This research brief uses data from the Pennsylvania Department of Education to examine how school districts used $6.0 billion of temporary COVID-19 funds.