Act 100 of 2016 transferred the responsibility to provide actuarial notes for legislation that proposes changes to public employee pension or pension plans to the Independent Fiscal Office (IFO). The IFO’s current Pension Analysis Policies is available here: http://www.ifo.state.pa.us//Resources/Documents/IFO_Pension_Analysis_Policy_2025_Update.pdf

All actuarial notes issued by the IFO are posted on this website and available in the “Actuarial Notes” link below. The IFO also publishes statutory and special reports on pension issues in the Commonwealth available in the “Special Reports” link. test

IFO Releases

General Fund Pension Impact Methodology

January 02, 2025 | Pension Analysis

The IFO will begin to project a five-year General Fund cost estimate as part of its pension analysis. This document uses proposed legislation from the 2023-2024 legislative session to detail the methodology used for those projections.

Summary and Analysis of Annual SERS Stress Test Report

November 27, 2024 | Pension Analysis

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the State Employee Retirement System’s (SERS) recent stress test report. Based on SERS baseline projections, the IFO projects that over the next 20 years, Commonwealth agencies will use $22.0 billion in General Fund revenues (1.8%) for employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance to exceed and fall short of baseline assumptions and the issuance of an 8.3% cost-of-living adjustment (equal to a 13th monthly annuity each year).

Summary and Analysis of Annual PSERS Stress Test Report

February 28, 2024 | Pension Analysis

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the Public School Employees Retirement System’s (PSERS) recent stress test report. Based on PSERS’ baseline projections, the IFO projects that from FY 2024-25 to FY 2051-52, the Commonwealth will use $53.0 billion in General Fund revenues (2.7%) for the state’s share of public school employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance to exceed and fall short of assumptions.

Summary and Analysis of Annual SERS Stress Test Report

December 01, 2023 | Pension Analysis

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the State Employee Retirement System’s (SERS) recent stress test report. Based on SERS baseline projections, the IFO projects that over the next 20 years, Commonwealth agencies will use $24.9 billion in General Fund revenues (2.0%) for employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance to exceed and fall short of baseline assumptions and the issuance of an 8.3% cost-of-living adjustment (equal to a 13th monthly annuity each year).

House Bill 1379 Presentation

September 07, 2023 | Pension Analysis

Fiscal Analyst Mathieu Taylor made a presentation to the House Local Government Committee regarding House Bill 1379, P.N. 1539. The bill would provide cost-of-living adjustments for certain retired municipal police officers and firefighters.

Tags: pension, presentation

Summary and Analysis of Annual PSERS Stress Test Report

March 01, 2023 | Pension Analysis

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the Public School Employees Retirement System’s (PSERS) recent stress test report. Based on PSERS baseline projections, the IFO projects that from FY 2023-24 to FY 2050-51, the Commonwealth will use $46.5 billion in General Fund revenues (2.3%) for the state’s share of public school employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance to exceed and fall short of baseline assumptions.

Summary and Analysis of Annual SERS Stress Test Report

December 01, 2022 | Pension Analysis

Pursuant to Act 128 of 2020, the IFO issued a report that summarizes results from the State Employee Retirement System’s (SERS) recent stress test report. Based on SERS baseline projections, the IFO projects that over the next 20 years, Commonwealth agencies will use $17.8 billion in General Fund revenues (1.5%) for employer pension contributions. Relative to baseline projections, the report also summarizes the impact from scenarios that allow investment performance and member salary growth to exceed and fall short of baseline assumptions.

Financial Impact of SERS Pre-Funding Option

June 09, 2022 | Pension Analysis

The IFO published a new research brief that examines the impact of Act 105 of 2019, which allows certain SERS employers the option to pre-fund their unfunded liabilities. The analysis finds that the two participating employers effectively locked in roughly $1 billion of nominal savings over thirty years while all SERS employers are projected to save an additional $300 million (nominal). The savings are due to very strong returns realized on advance payments made in 2020 and 2021.

Public Pension Status and Outlook

September 28, 2021 | Pension Analysis

The IFO released a research brief that provides a status update and outlook for public pension systems in Pennsylvania. Data for state and local systems show that while the fiscal health of public pension systems has improved in recent years, the overall unfunded liability remains significant.

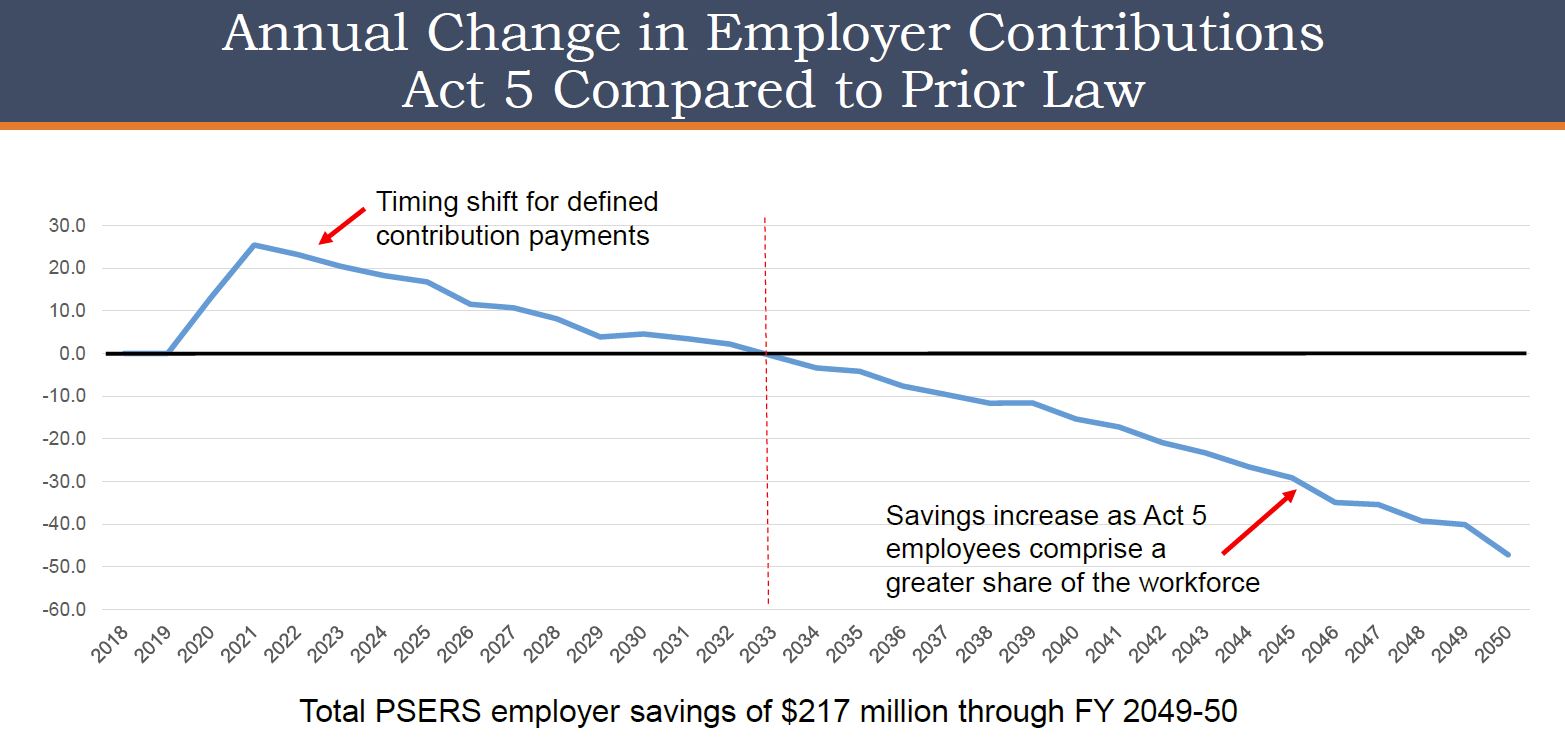

Actuarial Impact of Act 5 - School District Pension Contributions

June 28, 2017 | Pension Analysis

Deputy Director Mark Ryan made a presentation to the Pennsylvania School Boards Association (PSBA) regarding the impact of recently enacted pension legislation (Act 5 of 2017) on school district pension contributions.